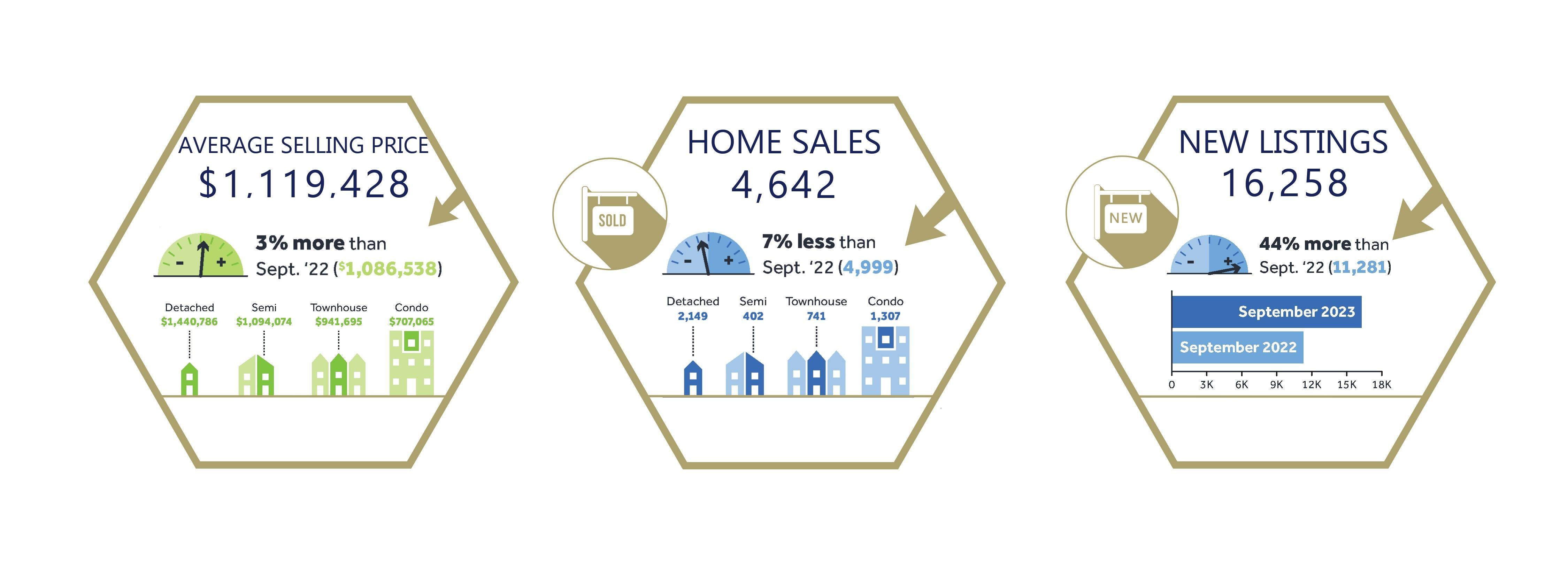

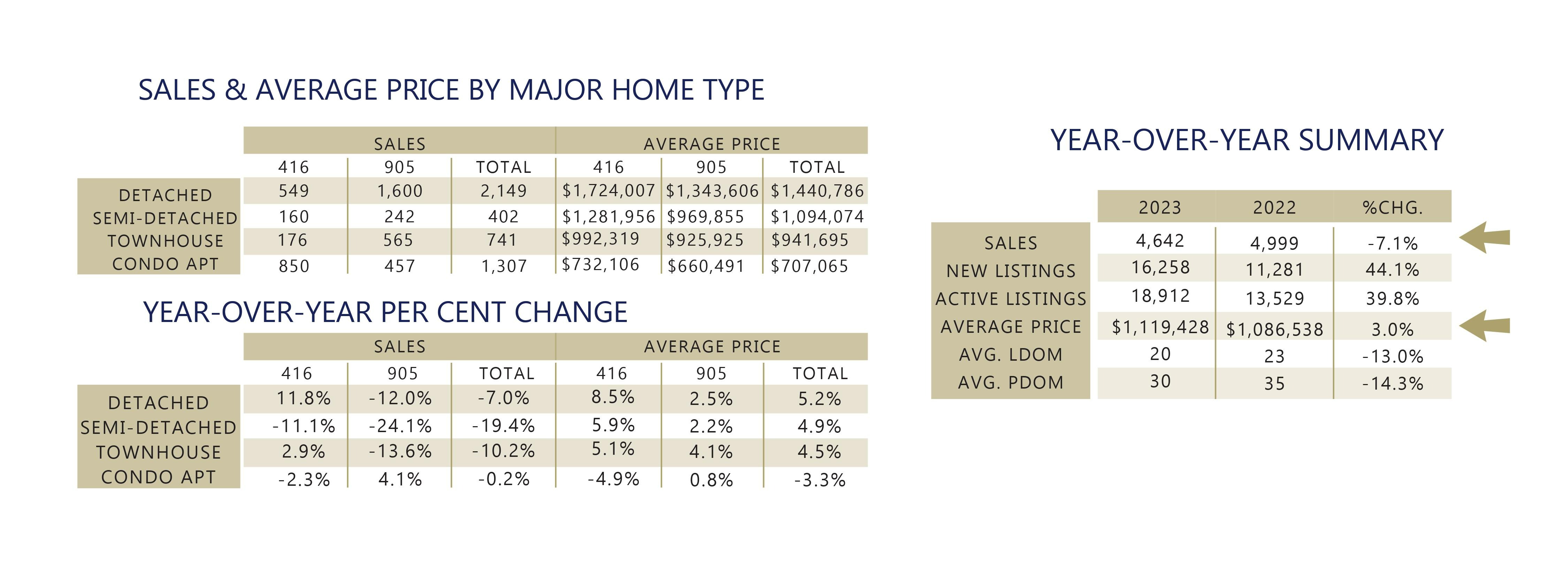

SEPTEMBER 2023 MARKET UPDATE |

The impact of high borrowing costs, high inflation, uncertainty surrounding future Bank of Canada decisions, and slower economic growth continued to weigh on GTA home sales in September. However, despite the market being better supplied with listings, the average selling price was up year over year. |

|

GTA home selling prices remain above the trough experienced early in the first quarter of 2023. However, we did experience a more balanced market in the summer and early fall, with listings increasing noticeably relative to sales. This suggests that some buyers may benefit from more negotiating power, at least in the short term. This could help offset the impact of high borrowing costs. |

|

CLICK HERE for the Full Market Report. |

Find Your Home Value.  |