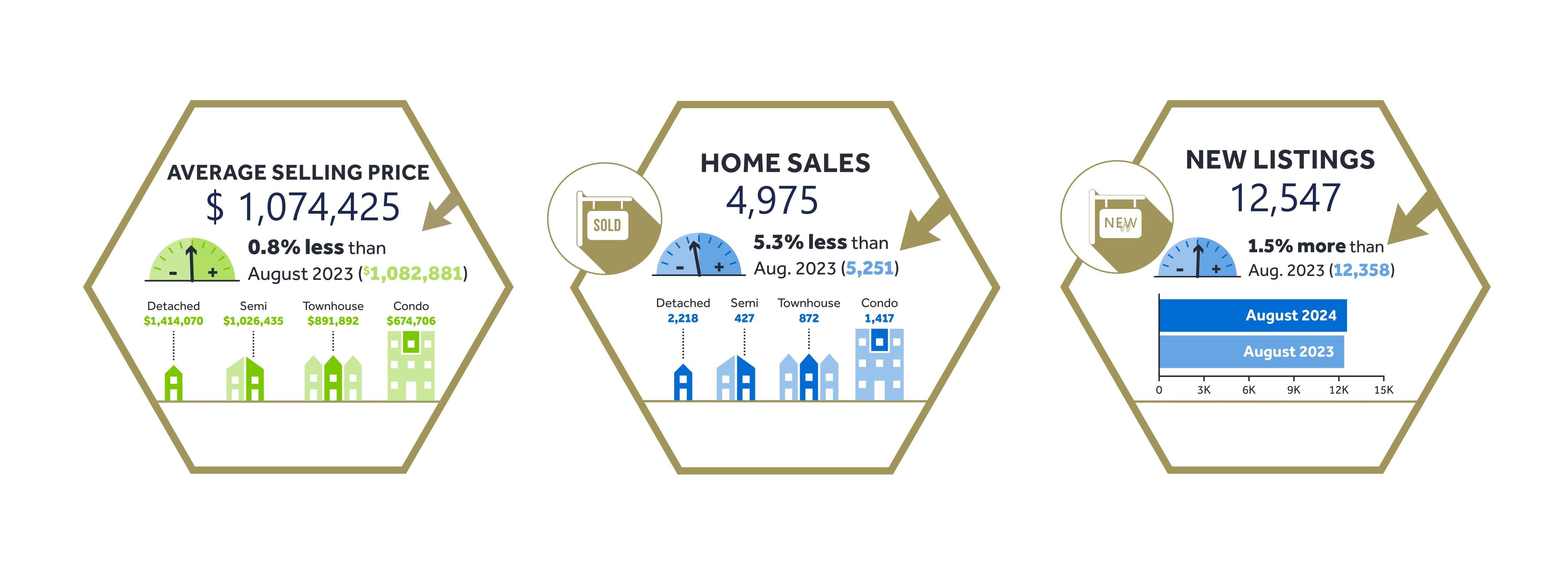

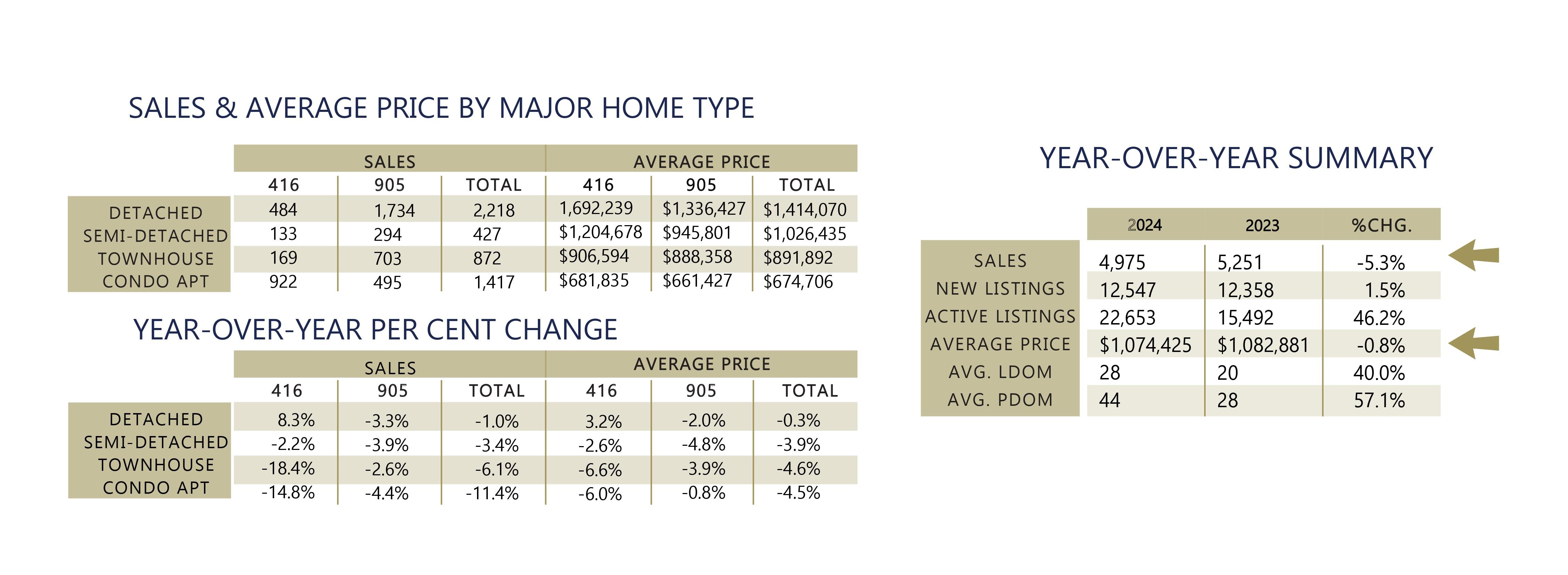

AUGUST 2024 MARKET UPDATE |

With the Bank of Canada announcing a rate cut on September 4, we expect to see a boost in affordability, particularly for those with variable-rate mortgages. This is especially beneficial for first-time buyers, who tend to be more sensitive to borrowing costs. As mortgage rates continue to decrease through this year and into next, we’re likely to see more first-time buyers entering the market, including increased interest in condos. |

|

What does this mean for you? With borrowing costs expected to trend lower over the next 18 months, buyers can take advantage of both reduced mortgage payments and slightly lower home prices. Even as demand is set to increase, especially in 2025, the current ample supply will help keep price growth in check, giving buyers a window of opportunity before the market picks up speed again. |

|

CLICK HERE for the Full Market Report. |

Find Your Home Value  |