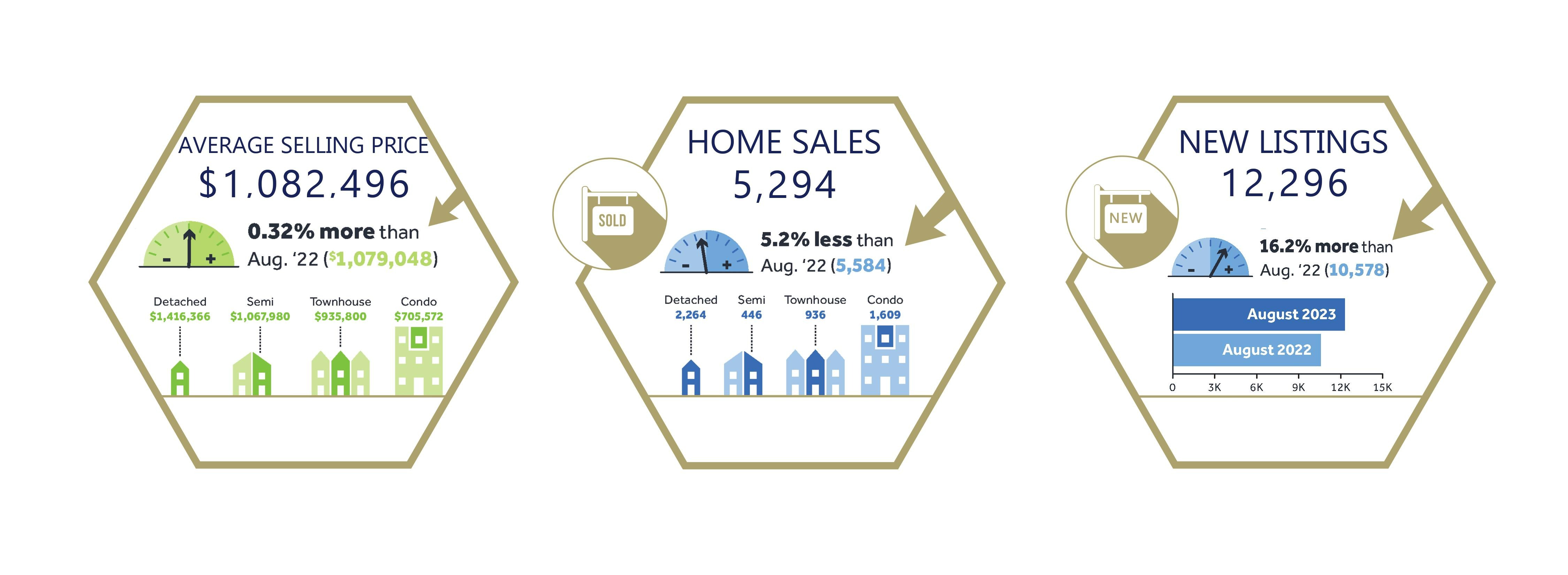

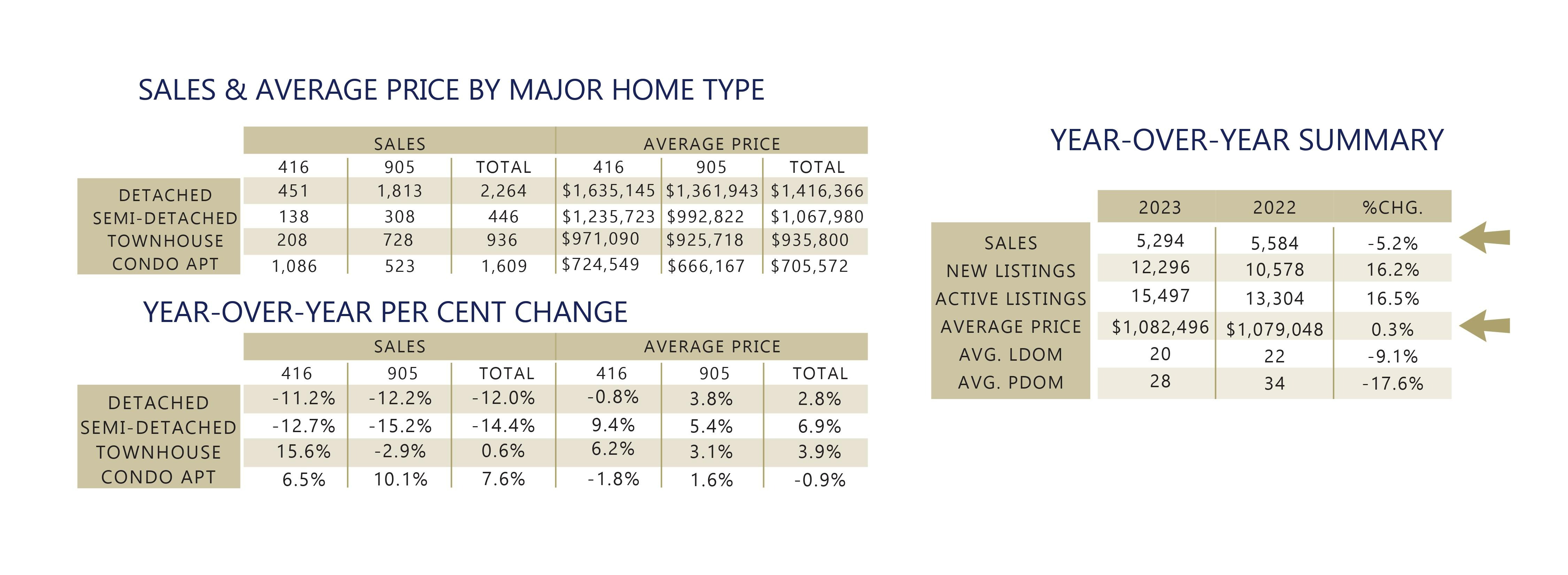

August 2023 MARKET UPDATE |

The Toronto Regional Real Estate Board has just released their numbers for the month of August and I am excited to share them with you. |

|

More balanced market conditions this summer compared to the tighter spring market resulted in selling prices hovering at last year’s levels and dipping slightly compared to July. As interest rates continued to increase in May, after a pause in the winter and early spring, many buyers have had to adjust their offers in order to qualify for higher monthly payments. Not all sellers have chosen to take lower than expected selling prices, resulting in fewer sales. |

|

CLICK HERE for the Full Market Report. |

Find Your Home Value.  |